Catalogue

1 China Pork Market Quotation.

2 European Pork Market Quotation.

3 American Pork Market Quotation.

1 China Pork Market Quotation

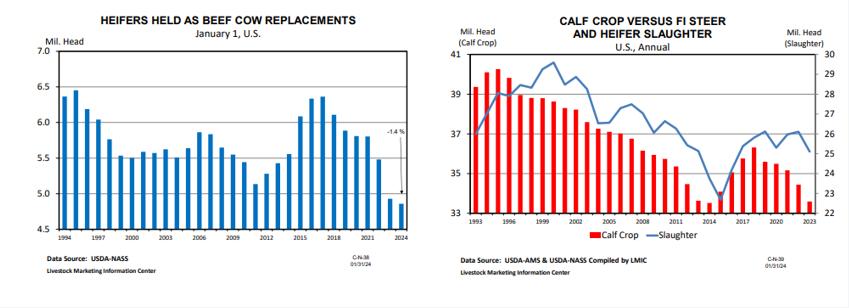

Live pig price of week 4 in 2024 was RMB14.24/kg, with an increase of 3.9% compared with last week but decline 7.59% compared with the same term of last year. The carcass price is RMB19.29/kg, with an increase of 4.3% compared with last week but decrease of 8.7% compared with last year. Due to the impact of a new round of rain and snow weather, transportation in the southern market was somewhat hindered. This had contributed to a rise in sentiment in the southern regions, and at the beginning of the week, pork price nationwide surged by over 14.5RMB/kg. However, after the increase of pig price, the follow-up demand from end customers was weak. Market expectations for future increased had diminished, leading to an increase in the enthusiasm for pig farming. Towards the end of the week, pork price was once again experiencing a narrow adjustment.

The piglet price of week 4 was RMB21.63/kg, with an increase of 6% compared with last week but with significant decrease of 20% compared with the same term of last year. The breeding sector anticipates strengthening expectations for the second half of next year. The sentiment for replenishing piglets is rising, driving an increase of piglet price.

2 European Pork Market Quotation

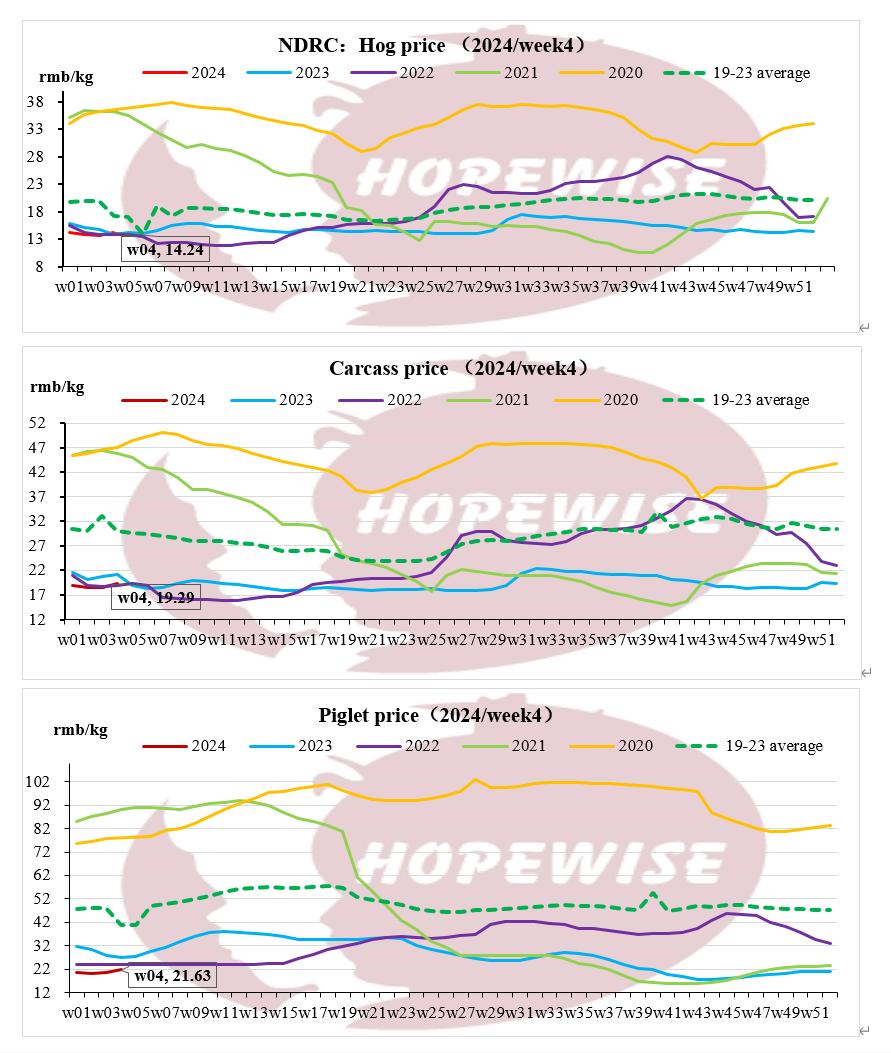

The

pork carcass price of EU in the last week was EUR2.03/kg with a decline of 1.1%

compared with last week and down 3.8% compared with four weeks ago as well as

decline 1% YOY. Piglet price was EUR78/head, with up 0.2% compared with last

week and up 1.7% compared with four weeks ago, as well as up 15.5% compared

with the same term of last year.

3American Pork Market Quotation

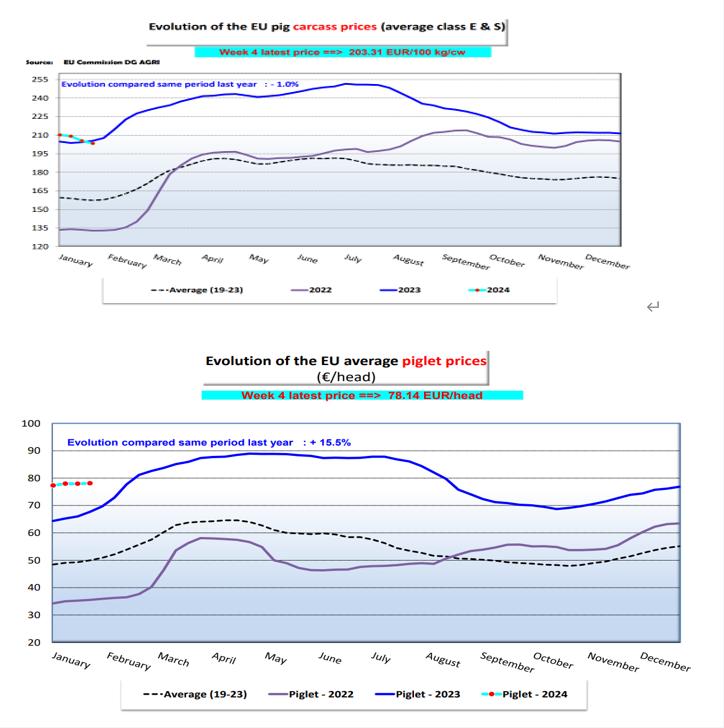

The US live pig price of last week was USD50.67/100lb, with up 8.25% compared with one week before last week but down 28.9% YOY. The cutout price was USD89.1/100lb, with up 1.23% compared with last week and up 11.43% compared with the same term of last year. The weekly slaughter volume was 2.71 million heads with an increase of 3.38%and up 6.78%.

4 Beef Market Quotation

South America

Brazil

With the start of the month, the slaughter cattle market witnesses a change in trend marked by increased demand and shortened bookings, leading to stable prices around R$/@ 220. Agrifatto reports a notable improvement in bone-in beef sales towards the end of the previous week, alleviating downward pressure on finished cattle prices.

Argentina

This week, export steer prices experienced another upward adjustment, particularly for high-quality British crossbreeds, reaching a range of Ar$ 3,100 to 3,200 per kilo on the hook. Zebu crosses, considered more rustic, are priced between Ar$ 2,900 and 3,000. Good cows also saw a nominal increase, reaching around Ar$ 2,600 to 2,750 per kilo on the hook. In contrast, the prices for "Chinese cows" remained unchanged from the previous week, fluctuating between Ar$ 2,100 and 2,300 per kilo.

North America

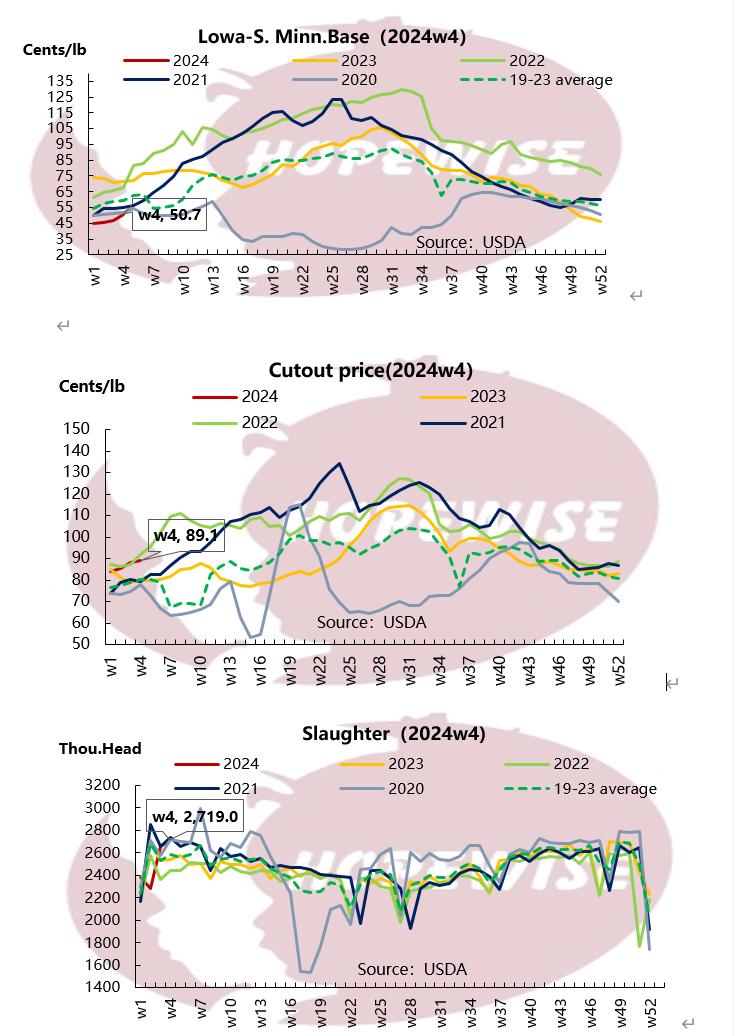

At the end of 2023, the USDA reported a 9% decrease in US red meat in cold storage, totaling 933.76 million pounds, driven by robust demand and reduced production. Beef witnessed an 11% decrease from the previous year, amounting to 485.127 million pounds, while pork decreased by 6% to 427.3 million pounds. Poultry supplies slightly exceeded the previous year at 1.127 billion pounds, with a notable 29% increase in turkey stocks compensating for a 6% decrease in chicken stocks. Additionally, US cattle feeders incurred an estimated loss of $133 per head in the week ending Jan. 20, with higher wholesale beef prices helping to alleviate packer losses by $100 per head, totaling $10. The total feed cost per head was $429, down about $6 from the previous week and significantly less than the feed costs for cattle sold during the same week a year ago.